Prediction Markets

Political polls are snapshots of the recent past. Polls have limited predictive power when conducted many days before an election.

Prediction markets, on the other hand, are forward-looking. Just as the stock market is a leading indicator of what will happen with the economy, a political prediction market is a leading indicator of what will happen with an election.

Prediction markets are efficient aggregators of public knowledge. Tens of thousands of observers of what is happening in the world and in the campaigns tell us what they think will happen in the future. They pay the price of the shares they purchase. They put their money down, taking a chance on what they think will happen. Prediction markets are markets. They show us the state of the world and anticipate the future.

Prediction markets are better than opinion polls because prediction markets respond to all factors relevant to an election. While opinion polls try to anticipate the behavior of likely voters on election day, prediction markets consider voting practices and contingencies as well as voter intentions. Prediction markets can also reflect voter demographics and economic conditions.

Well-designed prediction markets provide relevant, up-to-date information about investor expectations, responding to all events in the public sphere. If a candidate gives an especially good speech or convention events play well in the media, prediction market prices respond. If a candidate misspeaks or says something that reflects poorly on his or her character, that too can move prediction market prices.

Anything known to the public can affect prediction market prices. That includes what investors learn from the media, pollsters, analysts, pundits, and other prediction markets.

A believer in efficient markets might say that political prediction markets reflect collective information across all people willing to place bets on the outcomes of political contests. Prediction markets reflect the wisdom of the crowd.

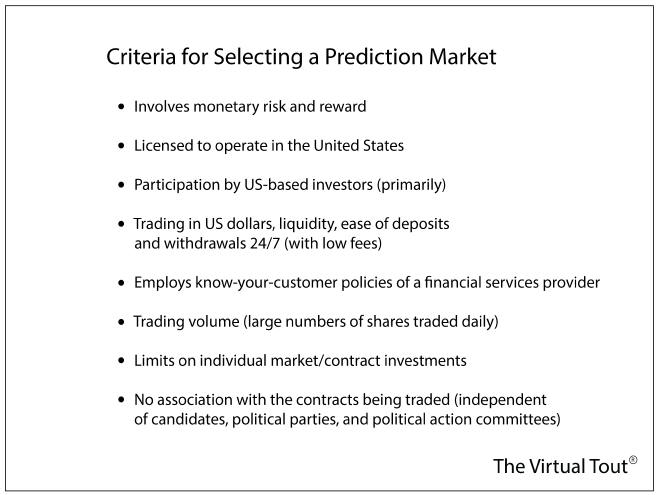

Not all prediction markets are created equal. We consider eight criteria when selecting a prediction market data source.

An additional consideration in the 2024 race for the US presidency was availability across the entire election cycle and across changes in the candidates running for office.

As we began our work in 2024, we considered three prediction markets as possible data sources for our election forecasts: the Iowa Electronic Markets, PredictIt, and Polymarket.

The Iowa Electronic Markets, a collection of nonprofit prediction markets at the University of Iowa, began as an experiment in 1988 with permission from the Commodity Futures Trading Commission (CFTC). During its first year of operation as a real-money prediction market, it was open only to University of Iowa students, faculty, and staff. The market was later opened to adult traders worldwide. Iowa Electronic Markets include aggregate markets for congressional and presidential elections. The presidential election has winner-take-all and vote-share contracts. Each trader has a total trading limit of $500 across all contracts/markets. This limits the influence of any individual trader.

PredictIt is an experimental project operated for academic purposes, with initial permission from the Commodities Futures Trading Commission (CFTC). PredictIt describes itself as “the stock market for politics.” Aristotle, a private, US-based company, operates PredictIt’s information systems. Victoria University of Wellington, New Zealand provides oversight, facilitating academic research into prediction markets.

Each PredictIt market/contract concerns a specific political event and bears an individual share price between 1 and 99 cents. Share prices change over time, reflecting traders’ beliefs about the probabilities of political events. The investment in each market/contract is limited to $850. This limits the influence of any individual trader on market prices.

PredictIt was licensed and available for the entire 2020 election cycle. But on August 2, 2022, a CFTC order instructed PredictIt to close its markets by February 15, 2023. PredictIt appealed the order. And on September 12, 2024, a DC District Court determined that the CFTC had exceeded its statutory authority. This ruling in favor of PredictIt and Kalshi, another prediction markets provider, opened the door to legalized betting on elections in the United States.

Polymarket is a decentralized prediction market built on the Ethereum blockchain network. Polymarket allows worldwide investors to buy and sell future-event contracts using USD Coin (USDC stablecoin) cryptocurrency.

Polymarket is an offshore operation. It does not have a CFTC license to operate in the United States. In January 2022, Polymarket was issued a cease and desist order by the CFTC. But this has not stopped US-based investors from using Polymarket.

A major limitation of Polymarket is technology. Prior to placing their bets, investors must set up a cryptocurrency wallet for exchanging US dollars for cryptocurrency and for making deposits and withdrawals. Polymarket Learn offers user training for Polymarket.

With Polymarket, there is no limit to the amount that can be invested in any prediction market/contract. As displayed on the Polymarket leaderboard, there are individual Polymarket investors holding positions in the millions of dollars.

Well-designed prediction markets avoid price manipulation by powerful speculators, and well-designed political prediction markets avoid price manipulation by players with a political agenda.

The quality of an analysis (or a prediction) is only as good as the data. Let’s summarize our evaluation of prediction markets as data sources for predicting the 2024 presidential election.

Polymarket is not a trustworthy data source for election forecasting because there is no dollar-limit on market/contract transactions. And the prediction markets of PredictIt have much higher trading volumes than the prediction markets of the Iowa Electronic Markets. Accordingly, The Virtual Tout® selected PredictIt as the data source for the 2024 presidential election. In particular, we selected the PredictIt market/contract for the party that will win the 2024 presidential election.

We can expect prices on prediction markets to be highly correlated. That is, prices usually go up and down in unison. But correlations do not tell the full story. It is the prices themselves that matter when making election forecasts. We see levels of prices (and consequently, levels of normalized prices for Democratic and Republican tickets) varying from one prediction market to the next.

There is an alternative to both political polls and prediction markets: prediction surveys from The Virtual Tout®. Like political polls, prediction surveys are not subject to CFTC regulation. Unfortunately, prediction surveys are expensive. They reward survey participants for correct predictions while charging nothing for participation.

Go to Political Research and Forecasting.

Go to the home page of The Virtual Tout.