Prediction Market Prices

The Virtual Tout® correctly predicted a Republican victory in the 2024 presidential election, but we underestimated the strength of that victory.

Experts in quantitative finance examine price movements for stocks, commodities, options, futures, indexes, and exchange-traded funds. A common measure in these analyses is the log daily return, computed as

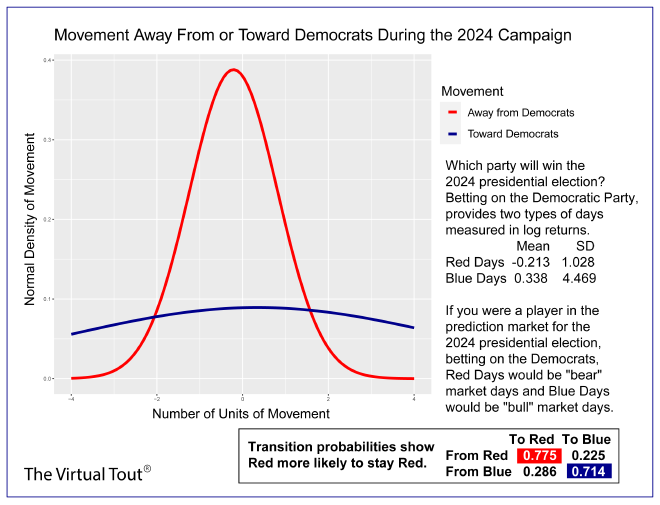

This represents the daily difference in log prices, multiplied by 100 (a scaling that is convenient for daily returns). Patterns in log returns over time are aligned with types of trading days. It is not uncommon to observe trading regimes or sequences of bear and bull market days.

Applying methods of quantitative finance to prediction market data for the 2024 presidential election, provides insight into the strength of the Republican victory.

The table of transition probabilities shows that days moving in the Republican direction were more likely to be followed by days moving further in the Republican direction, compared with days moving in the Democratic direction being followed by days moving further in the Democratic direction. In simple terms, Trump/Vance traders were more likely to stay Trump/Vance traders.

We reviewed this analysis and others in the online webinar: Data Debrief: Predicting the 2024 Presidential Election. This Northwestern-University-hosted event was held on Tuesday, January 14, 2025: Listen to the Recording.

The Virtual Tout® provides quantitative analysis of prediction markets with a focus on political and economic events. We post research results, forecasts, and commentary on this site.

For up-to-the-minute forecasts and analysis, see TinyTicker™.

See the log of Blog postings.

The most recent news is on the home page.